- 2024-12-16

A Must-Read for Cryptocurrency Beginners! How to Profit from Bitcoin and Key Points to Watch Out For

In recent years, more people have started investing in Bitco……

“Is Bitcoin’s price crash scary?”

“Is there a risk of hacking?”

Even if you’re interested in Bitcoin, hearing about these kinds of risks might make you hesitant to invest. Negative news can make Bitcoin trading seem extremely risky.

In this article, we will explain the current risks associated with Bitcoin and provide key points to help reduce those risks.

By acquiring the right knowledge, you can overcome your fears and approach Bitcoin trading with greater confidence.

6 Risks Associated with Bitcoin and How to Mitigate Them

One of the primary concerns with cryptocurrencies is the risk of exchanges being hacked. If an exchange is hacked, withdrawals and deposits may be halted, and trading activities may become impossible.

In the past, there have been major incidents of large-scale asset theft due to hacking, which fueled public anxiety about cryptocurrencies. As a result of these incidents, Japan’s Financial Services Agency (FSA) urges users to trade only on registered exchanges.

It’s important to note that not all exchanges offer compensation in the event of a hack. This is because national regulations do not yet clearly define compensation policies.

Recommendation: To mitigate this risk, always use a reputable and secure exchange for Bitcoin transactions.

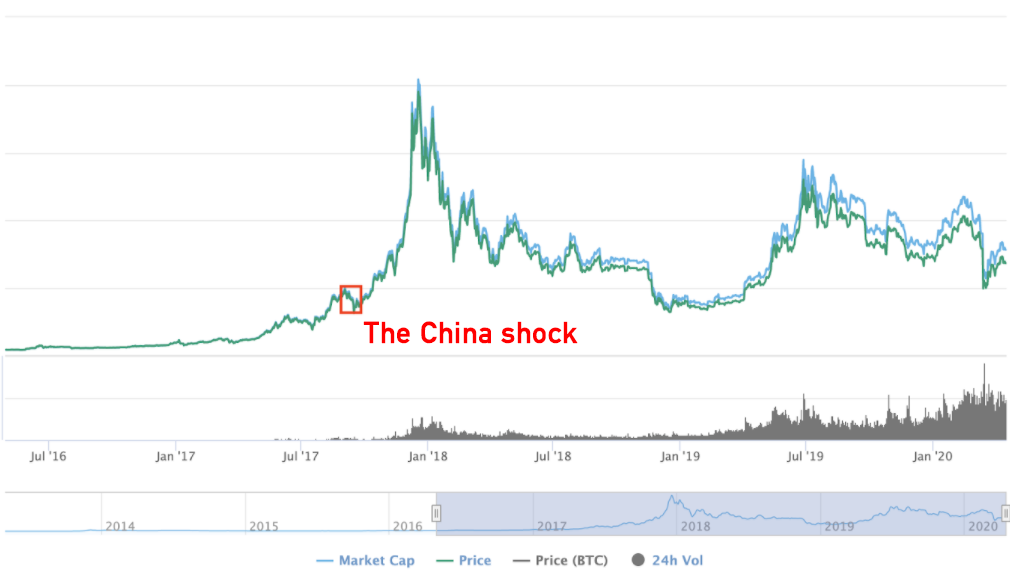

Government regulations can significantly impact Bitcoin prices. If the market views a regulatory measure positively, prices may rise. Conversely, if the measure is seen negatively, prices are likely to fall.

For example, in China:

These regulations specifically targeted transactions involving the yuan and caused considerable market fluctuations.

However, due to these regulations, Chinese investors — who once held the largest market share — withdrew suddenly, causing Bitcoin’s price to drop by over 30%. This event became known as the “China Shock.”

One significant risk with cryptocurrencies is the possibility of “Self-Gox.” Self-Gox refers to losing your cryptocurrencies due to user error. The term originates from the infamous Mt. Gox incident.

In cryptocurrency trading, you manage your assets using a private key, which acts like a password. If you lose your private key, you will be unable to access your assets.

Additionally, cryptocurrency transactions require an address. If you mistakenly send funds to the wrong address, those coins are generally irretrievable.

Other examples of Self-Gox include losing the password to your cryptocurrency wallet. To prevent this, ensure you back up your passwords regularly.

To avoid these mistakes, it’s essential to carefully manage your private keys, addresses, and passwords.

There are five main types of cryptocurrency wallets:

Web wallets and hardware wallets connect to the internet, making them susceptible to virus infections. If a virus infects your device, it could lead to the theft of your private keys.

While desktop wallets and mobile wallets are convenient, paper wallets (which store information on printed paper) are considered safer against hacking attempts.

To mitigate this risk, ensure your computer is free from viruses by:

If purchasing a hardware wallet, buy it from an official website to avoid potential virus infections.

By taking these precautions, you can protect your cryptocurrency assets from viruses and hacking threats.

While cryptocurrencies are often associated with high earnings potential, it’s important to recognize the risk of price crashes. Cryptocurrencies are characterized by high volatility, with no mechanisms like stock market price limits (e.g., upper or lower daily price limits). This means prices can continue to rise or fall without restriction.

Some exchanges have implemented circuit breakers to temporarily pause trading during extreme price swings, but these measures are only temporary. To minimize losses, it’s crucial to take proactive steps, such as cutting losses early.

In the world of investing, you may have heard the term “dead money” or “holding the bag”. This refers to a situation where a financial asset’s value has dropped significantly, and the investor chooses to hold onto it rather than sell at a loss. In this scenario, the asset remains unsold, but the investor doesn’t recover their capital.

Although holding the asset avoids realizing the loss, it also means there’s no way to recover funds. When trading cryptocurrencies, it’s essential to establish clear buy and sell rules in advance. This includes setting not only profit targets but also a predetermined loss threshold to cut losses and prevent prolonged financial stagnation.

By following these strategies, you can manage risks and make informed decisions when trading cryptocurrencies.

To reduce risk as much as possible, here are three essential steps to take before trading Bitcoin.

Let’s break down each strategy.

To minimize risk, it’s best to start small and use only surplus funds. If beginners invest large sums right away, they may struggle to handle the volatile market, potentially leading to significant losses.

Starting with a small investment is a key risk management strategy.

Additionally, avoid trying to achieve a “get-rich-quick” turnaround with cryptocurrency. It’s wiser to invest funds that you can afford to lose without it affecting your finances.

Cryptocurrency exchanges can be vulnerable to hacking or even collapse, causing significant financial losses. Therefore, it’s crucial to carefully choose a reputable exchange.

When selecting an exchange, consider the following:

Thorough research will help you find a secure and reliable exchange.

Gaining the right knowledge and staying updated with the latest information is crucial when investing in cryptocurrencies. Relying on posts or claims like “I made huge profits” found on the internet or social media without verifying the information can be dangerous.

While some information is trustworthy, there are scams targeting beginners. Be wary of statements like:

Such claims are often red flags.

Before you invest, acquire knowledge from trusted sources such as:

Keep an eye on factors like global regulations and world events, as these can significantly impact cryptocurrency prices.

By staying informed and adopting these strategies, you can approach Bitcoin trading with greater confidence and lower risk.

Let’s recap the key points discussed in this article about Bitcoin trading risks and risk management strategies.

6 Key Risks of Bitcoin Trading:

3 Strategies to Minimize Bitcoin Trading Risks:

You may hear worrying news about Bitcoin trading, but compared to when Bitcoin first emerged, the situation has significantly improved. While there is potential to make a profit, all investments come with risk.

By gathering information, staying aware of the risks, and following these key strategies, you can trade Bitcoin more safely and confidently.

Start with a small investment and take your first step into Bitcoin trading!