- 2024-12-13

How to Identify the Best Time to Buy Bitcoin! Plus, Insights on Its Future Potential

Bitcoin, one of the most prominent cryptocurrencies, is grow……

![[For Beginners] What is Bitcoin? An Easy-to-Understand Explanation of How It Works!](https://forex-profit-hub.com/wp-content/uploads/2024/12/pexels-karolina-grabowska-5980738-1280x853.jpg)

Bitcoin (BTC) is well-known as the leading cryptocurrency (digital asset). As its price and popularity continue to rise, Bitcoin is increasingly becoming a topic of discussion, even among people who previously had no interest in cryptocurrencies. However, some may feel, “I’m curious, but it seems a bit complicated…”

In this article, we will explain the basics, workings, and features of Bitcoin in a way that even beginners can easily understand.

Summary of This Article

Bitcoin is the world’s first blockchain-based digital currency. One of its key features is that it has no central authority, such as a central bank, to manage it.

Because Bitcoin is the most well-known cryptocurrency in circulation, many people mistakenly believe that “Bitcoin = cryptocurrency.” However, Bitcoin and cryptocurrency are not synonymous.

Just as the term “currency” includes the Japanese yen, U.S. dollar, and euro, Bitcoin is just one type among many cryptocurrencies.

| Unit | BTC |

| Market Capitalization (as of May 18, 2022) | Approximately 73.7 trillion yen (Rank: 1st) |

| Maximum Supply | 21 million coins |

| Consensus Algorithm | Proof of Work (PoW) |

| Whitepaper | Bitcoin.pdf |

| Official Website | Bitcoin.org |

Bitcoin began in October 2008 when a person using the pseudonym Satoshi Nakamoto published a paper online. The paper described a decentralized cryptocurrency that didn’t rely on nations or banks for management.

Three months later, in January 2009, an open-source software based on Nakamoto’s paper was developed and released. This was the first version of Bitcoin as we know it today.

However, the concept of cryptocurrency—entirely different from traditional money—along with blockchain technology and a financial system without centralized authority, was too innovative to be widely accepted at first.

Nevertheless, by February 2010, the first Bitcoin exchange was established, and trading quickly began.

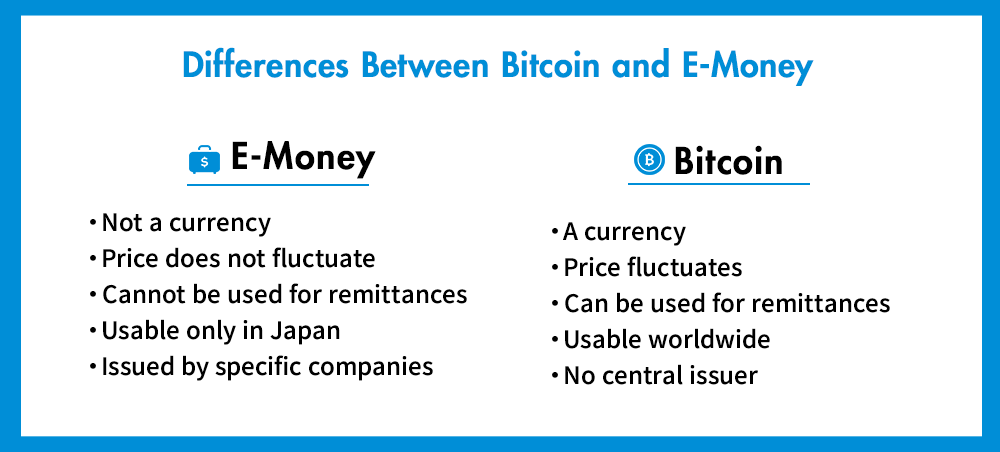

Cryptocurrencies like Bitcoin are different from electronic money. Both record currency value as digital data, which makes them similar in that regard.

However, electronic money is a digital form of currency issued by a nation, similar to prepaid cards. For example, Suica and PASMO, which are used for trains and buses, represent Japanese yen in electronic form.

In contrast, cryptocurrencies such as Bitcoin have no connection to currency issued or guaranteed by a nation or central bank.

Additionally, while the prices of cryptocurrencies fluctuate depending on the market, electronic money is pegged to the yen or another fiat currency, so the value of the charged amount does not change. Other differences include the ability to transfer funds and the regions where they can be used.

Next, we will explain the following five unique mechanisms and features of Bitcoin in a way that even beginners can easily understand:

Bitcoin uses a technology called blockchain for its transactions.

Blockchain serves as the foundation of Bitcoin transactions and essentially acts as a ledger that records these transactions.

Transaction data, known as transactions, are managed in blocks. These blocks are linked together in a chain and distributed across the network, which is why it is called a blockchain.

Although the structure is quite simple, blockchain technology is resistant to data tampering and is well-suited for recording transaction histories. For this reason, blockchain is used as the recording method for transactions in Bitcoin and other cryptocurrencies.

Unlike the Japanese yen or the U.S. dollar, Bitcoin is not issued or guaranteed by a nation or central bank.

Although there are groups of core developers and contributors, there is no central bank to adjust the currency’s supply based on market trends or intervene in transactions. For example, in Japan, this role is played by the Bank of Japan, and in the U.S., by the Federal Reserve (FRB). Bitcoin has no equivalent governing organization.

Bitcoin’s goal was to create a currency free from centralized control or national authority. This decentralized nature is a key feature not only of Bitcoin but also of subsequent cryptocurrencies.

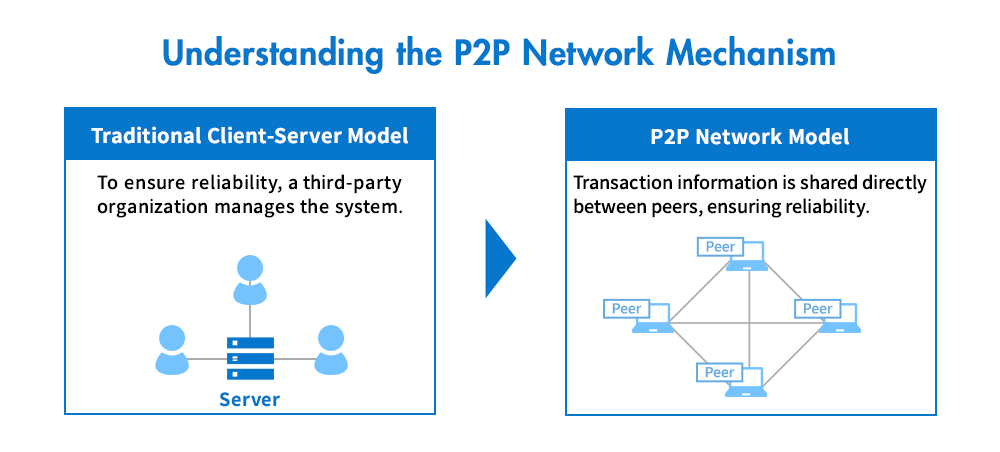

The fact that Bitcoin has no central bank also means that its transaction information is not stored in a single location.

In traditional banking, currency and transaction information are managed through central vaults or strictly secured main servers. In contrast, Bitcoin operates through a peer-to-peer (P2P) network of devices that download the software and participate in transactions.

In a traditional client-server system, if the server crashes, the entire system can go down. However, in a P2P network where clients communicate in a decentralized manner, the system can continue to operate even if some devices go offline.

Bitcoin’s transaction data is recorded and shared across countless devices worldwide—such as PCs, smartphones, and tablets—ensuring data integrity and security. Rather than relying on a nation’s authority, Bitcoin’s value is maintained by the trust of global users who transact based on a predefined program.

From the moment Bitcoin was created, its maximum supply was set at 21 million coins. This limit is a part of Bitcoin’s specifications and is embedded in its code, meaning no more than this amount can ever be issued.

Many cryptocurrencies also have predetermined issuance limits, though the total supply and the rationale behind these limits vary.

In the case of traditional fiat currencies, central banks can adjust the money supply to influence economic trends. However, if too much currency is issued, it can lose value and cause inflation.

Since Bitcoin lacks a central authority to manage supply, unchecked issuance could lead to an oversupply in the market, reducing Bitcoin’s value. To prevent this, a maximum issuance limit was established.

This fixed supply limit contributes to expectations of future price increases and fosters a speculative tendency toward Bitcoin.

As long as you have an internet connection, you can send Bitcoin anytime, 24/7, regardless of the recipient’s location.

Compared to traditional international bank transfers, Bitcoin offers significantly faster settlement times. Transfers that used to take several days can now be completed within minutes.

This rapid international transfer capability is made possible by blockchain technology, which underpins Bitcoin and other cryptocurrencies.

As a new type of financial instrument, alongside stocks and foreign exchange, Bitcoin is gaining attention worldwide. Bitcoin offers several advantages that differ from cash or credit cards. Here, we explain three key benefits of Bitcoin in a way that beginners can easily understand

The first benefit is the ability to transfer funds directly between individuals. The concept of “direct transfers” with cryptocurrencies might not be immediately clear, but it is a significant advantage.

When buying or selling online or sending money to a child living far away, bank transfers are typically used. However, bank transfers can involve delays before the recipient receives the funds. If a check is sent to a different bank, it may require additional time for verification, and international transfers can often take several days.

With Bitcoin, international transfers are completed remarkably quickly. In theory, a transfer can be processed in as little as 10 minutes, and in practice, it usually takes no more than 40 minutes, regardless of where the recipient is located.

Another advantage of Bitcoin is the low cost of international transfers. This is not unique to Bitcoin but applies to cryptocurrencies in general.

For fiat currencies like yen or dollars, transactions require intermediaries like banks, which charge fees for their services. In contrast, Bitcoin has no intermediary organizations, so when transferring funds directly between individuals, there is generally no transaction fee.

The third benefit is that Bitcoin can be used worldwide without the need for currency exchange.

When traveling abroad, it’s often necessary to have local currency on hand. Typically, travelers exchange money at a bank before departure or at an airport upon arrival, but these exchanges come with fees. For example, exchanging U.S. dollars at a domestic bank might incur a fee of about 3 yen per dollar. Exchanging $1,000 means paying about 3,000 yen in fees. Fees apply when converting back to yen after the trip as well.

When paying with Bitcoin, you can avoid currency exchange fees and only need to cover the transaction fee. At restaurants and shops that accept Bitcoin, a QR code for payment is displayed on a tablet or similar device. You simply scan the QR code with a smartphone app and send the payment, making the process as straightforward as paying with cash.

Every year, more stores are accepting Bitcoin. For merchants, Bitcoin payments can be more appealing than credit cards, which typically require them to pay fees of several percent. This is one reason Bitcoin payments are gradually gaining popularity.

While the world is optimistic about Bitcoin’s potential, it does come with its drawbacks. Here, we explain three key disadvantages of Bitcoin in a way that beginners can easily understand

The first drawback is Bitcoin’s extreme price volatility. Bitcoin’s price can fluctuate dramatically, sometimes experiencing significant ups and downs within a single day.

For investors who prefer more stable financial assets, this volatility is a disadvantage. However, some people view these price swings as opportunities for profit.

The second drawback is that instant settlement can be challenging. When a Bitcoin transaction is initiated, it needs to be verified to ensure there are no errors or fraud before it is confirmed. As a result, even after a transfer is sent, the funds do not arrive immediately, making instant settlement difficult.

However, when paying at stores or restaurants, instant settlement is possible if you use a wallet specified by the merchant. If you use a wallet other than the one specified, transfers may take longer or, in some cases, the Bitcoin payment may be invalidated. Therefore, it’s important to pay attention to the wallet used.

The third drawback is the limited availability of Bitcoin payment services.

While some physical stores accept Bitcoin payments directly through wallets, online shopping is a different story. Like credit cards, a payment service that mediates between the user and the merchant is required for Bitcoin transactions.

A system that instantly converts Bitcoin transfers into Japanese yen and settles payments monthly would benefit both users and merchants.

Currently, a few companies offer Bitcoin payment services, and more e-commerce sites are adopting them. However, the number of companies providing these services is still insufficient, and expanding this ecosystem is one of Bitcoin’s key challenges for the future.

Next, let’s look at some practical ways Bitcoin is being used today. As of now, Bitcoin serves the following purposes:

While Bitcoin is often associated with investment and asset management, it can also be used for various purposes, including online and in-store purchases, paying utility bills, and international transfers.

When Bitcoin was created in January 2009, it had not yet been recognized as a currency with value.

Bitcoin first received a price in October 2009 when the website New Liberty Standard set the rate at 1 BTC = approximately 0.07 yen. This price was calculated based on the electricity costs involved in mining Bitcoin.

The following year, in May 2010, a programmer in Florida purchased two pizzas for 10,000 BTC. At the time, Bitcoin’s value was 1 BTC = approximately 0.2 yen. This is known as the first recorded payment using Bitcoin.

Despite various ups and downs, Bitcoin grew at an astonishing rate. In November 2021, Bitcoin reached its all-time high of 1 BTC = 7.6 million yen. This remarkable 13-year growth—an increase of approximately 38 million times—astounded many people. Bitcoin’s unprecedented growth has made it a high-ROI (Return on Investment) financial product that attracts investors worldwide.

Since late July 2020, Bitcoin has consistently maintained a price above 1 million yen, showing strong performance. But what does the future hold for Bitcoin’s price? Here are five key factors that could influence its future trends:

Bitcoin’s price has already risen significantly. While there is still potential for further increases, in the world of investing, when prices rise too high, it can be difficult to expect further significant gains. This means there is a higher chance that large profits may be harder to achieve.

To efficiently generate profits in such situations, it’s recommended to use leverage. Leverage allows you to aim for substantial gains even with small price movements.

If you want to trade Bitcoin or other cryptocurrencies with leverage, using FX brokers like XMTrading or FXPro is convenient.

✔ What is Leverage?

Leverage is a mechanism that allows you to make large trades with a small amount of capital.

For example, with 10x leverage, you can trade 100,000 yen worth of assets with just 10,000 yen of capital. This enables you to profit significantly even from small price changes.

In addition to using leverage, FX brokers offer significant advantages, such as the zero-cut system.

Many beginners worry, “If I lose money with leverage trading, will I end up in debt?” However, with the zero-cut system, you don’t need to worry.

If your losses increase, your position will be automatically closed (stop-out) at a certain level, preventing your account balance from going negative. This ensures you can trade with peace of mind.

Unlike standard cryptocurrency exchanges, where you can only “buy low and sell high,” FX brokers allow you to “sell high and buy back low” (taking a short position).

With short positions, you have the opportunity to profit even when prices are falling. This means you can aim for profits regardless of market direction, enabling more flexible trading strategies.

Even beginners can aim for efficient profits by effectively using FX brokers and leverage. Manage your risks carefully and try your hand at Bitcoin trading!

Bitcoin, the first cryptocurrency ever created, remains synonymous with the entire crypto market.

With its popularity and market capitalization ranking highest, Bitcoin is a foundational coin to consider when starting out with cryptocurrencies. In the real world, it can be compared to the U.S. dollar—a major global hard currency used for international transactions.

In any case, if you plan to invest in Bitcoin, be sure to gather sufficient information and carefully consider your options before getting started.

In addition to using leverage, FX brokers offer significant advantages, such as the zero-cut system.

Many beginners worry, “If I lose money with leverage trading, will I end up in debt?” However, with the zero-cut system, you don’t need to worry.

If your losses increase, your position will be automatically closed (stop-out) at a certain level, preventing your account balance from going negative. This ensures you can trade with peace of mind.

Unlike standard cryptocurrency exchanges, where you can only “buy low and sell high,” FX brokers allow you to “sell high and buy back low” (taking a short position).

With short positions, you have the opportunity to profit even when prices are falling. This means you can aim for profits regardless of market direction, enabling more flexible trading strategies.

Even beginners can aim for efficient profits by effectively using FX brokers and leverage. Manage your risks carefully and try your hand at Bitcoin trading!

Bitcoin, the first cryptocurrency ever created, remains synonymous with the entire crypto market.

With its popularity and market capitalization ranking highest, Bitcoin is a foundational coin to consider when starting out with cryptocurrencies. In the real world, it can be compared to the U.S. dollar—a major global hard currency used for international transactions.

In any case, if you plan to invest in Bitcoin, be sure to gather sufficient information and carefully consider your options before getting started.