- 2025-01-31

WTI Crude Oil Price Trends and Investment Insights: Geopolitical Risks and Chart Analysis

WTI Daily Chart Crude oil prices rose temporarily……

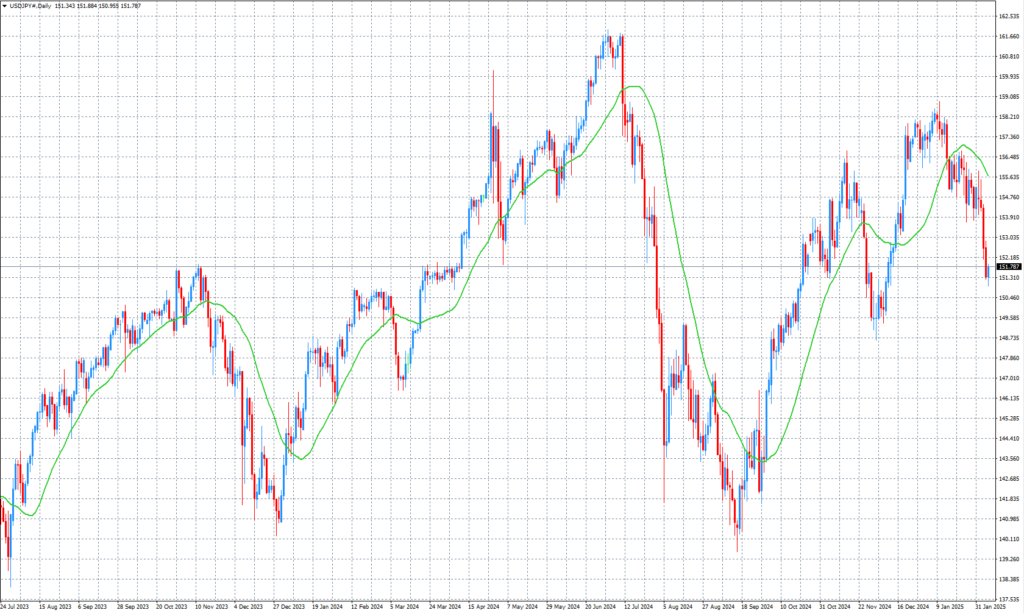

USD/JPY Daily Chart

Currently, USD/JPY is trading near its highest levels since November, with the Japanese yen showing significant strength. This is largely due to increasing expectations of the Bank of Japan (BOJ) raising interest rates. As a result, the yen is projected to rise by approximately 2.3% on a weekly basis, drawing attention from investors. At the same time, the U.S. dollar’s trajectory is under scrutiny ahead of the release of non-farm payroll data, which may bring further fluctuations. While most Asian currencies are trading weakly, the yen’s rise stands out prominently.

The yen is likely to maintain its upward momentum as BOJ rate hikes are anticipated. Predictions suggest that policy rates may rise to 1% by the end of 2025, supported by strong domestic wage growth and increased household spending. Meanwhile, the U.S. dollar’s direction depends on the outcome of the non-farm payroll data. A robust labor market could stabilize the dollar further, though Asian markets might face short-term pressures.

A look at the daily USD/JPY chart shows a consolidation phase around the lower 150 levels. With a visible downward trend over recent months, further yen strength seems plausible in the short term. Key support levels near 151 yen will be critical to watch.

This article is here to help you take the first step into investing by leveraging the current yen appreciation trend. Based on the insights shared, consider the following actions for your investment strategy: