Understanding Dollar Strength and Asian Currency Movements: A Beginner-Friendly Forex Outlook

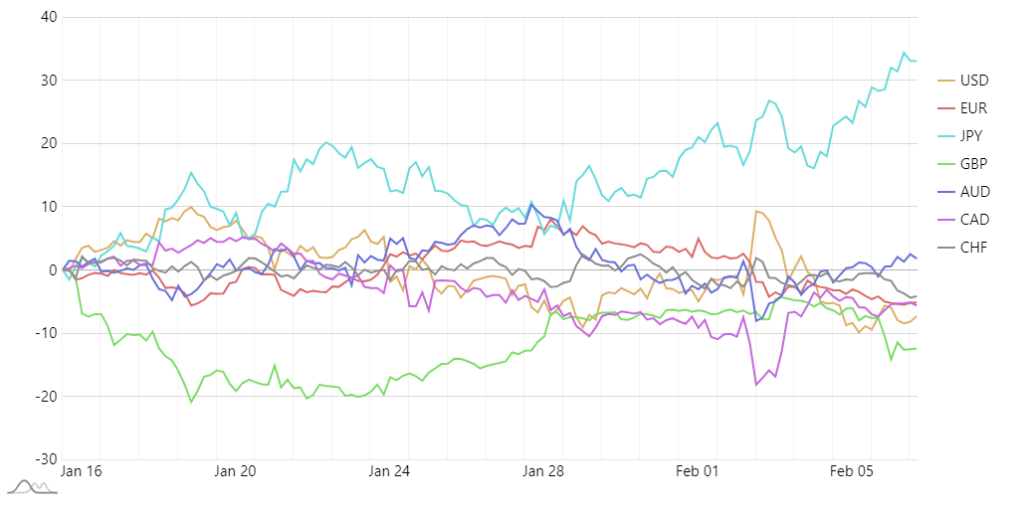

Currency Strength Chart for the past 30 days

As of February 9, 2025, the U.S. dollar surged following President Donald Trump’s announcement of a 25% tariff on metal imports, while most Asian currencies weakened. The Japanese yen and Chinese yuan faced significant declines, with China’s weaker-than-expected inflation data contributing to the yuan’s drop. Based on the provided chart, this article explores the current state of the forex market and its future outlook.

Future Outlook and Predictions

- Sustained Dollar Strength

The U.S. dollar is likely to remain strong as Trump’s policies may drive domestic inflation higher, prompting the Federal Reserve to maintain elevated interest rates. - Chinese Yuan’s Downward Pressure

Weaker inflation data highlights China’s economic fragility, posing further risks to the yuan. However, increased government stimulus could help stabilize the currency over time. - Japanese Yen Volatility

Despite occasional strength, weak data and a shrinking current account surplus have weighed on the yen. Its performance will remain uncertain amid market volatility. - Asian Currencies

Currencies like the Australian dollar and Korean won are expected to face short-term pressure due to U.S. trade tariffs, with potential shifts driven by central bank policies.

Investment Decision

- Market Trends

The dollar shows an upward trend, while Asian currencies are likely to remain under pressure. - Recommended Investment Period

- Dollar: Medium to long term.

- Asian currencies: Short-term opportunities with caution.

Beginner Investment Advice

- Now is a Great Time to Buy Dollars

The dollar is currently showing a steady upward trend, making it an excellent choice for medium-term investments. Consider buying dollars now as a strategic move. - Explore Short-Term Trading with Yen and Yuan

The Japanese yen and Chinese yuan are experiencing short-term volatility. Use the chart to time your trades and start with small amounts to understand the market dynamics. - Open an FX Trading Account

To take full advantage of the insights in this article, the first step is to open an FX trading account. Choose a user-friendly platform and start trading with small amounts to gain experience.