- 2025-01-31

WTI Crude Oil Price Trends and Investment Insights: Geopolitical Risks and Chart Analysis

WTI Daily Chart Crude oil prices rose temporarily……

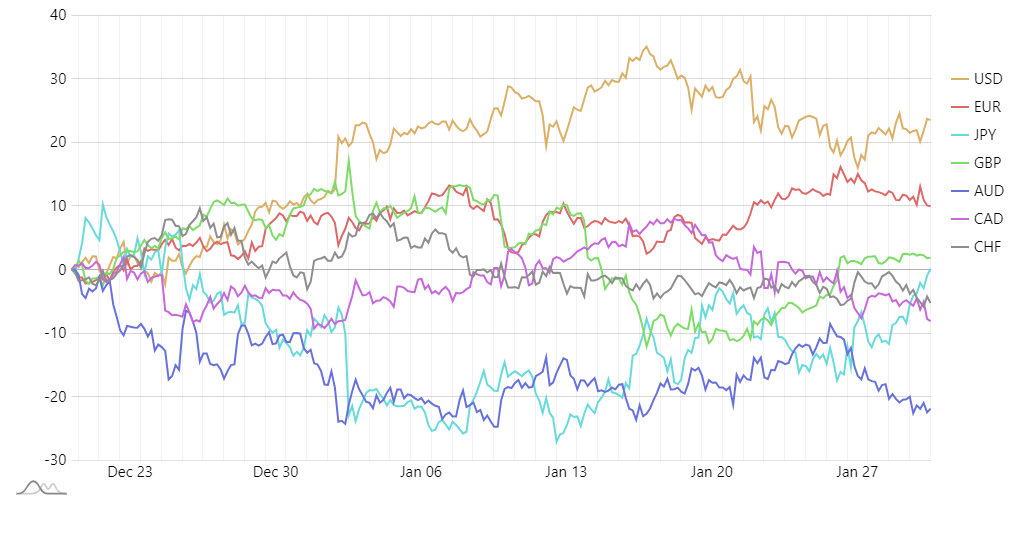

Currency Strength 3 Month

U.S. President Donald Trump recently reiterated his threat to impose a 100% tariff on BRICS nations if they attempt to establish a new currency to rival the U.S. dollar. The BRICS group, which includes Brazil, Russia, India, China, South Africa, and newly joined nations like Egypt and Indonesia, has been discussing reducing reliance on the dollar for years. However, Trump’s rhetoric underlines the continued dominance of the U.S. dollar, bolstered by a strong U.S. economy, tightened monetary policy, and geopolitical tensions.

Trump’s tariff warning coincides with rising concerns over global fragmentation as BRICS nations push to transition away from the dollar. Despite their efforts, the dollar remains the world’s leading reserve currency, with no viable challenger in sight, according to recent research. Investors are closely watching how these developments might impact currency markets and international trade.

1. Currency Strength Insights from the Chart

The attached currency strength chart illustrates that the USD has strengthened significantly over the past three months, standing well above other currencies like the EUR, JPY, and GBP. This trend indicates heightened demand for the dollar as a safe-haven asset amidst geopolitical tensions and global economic fragmentation.

2. Impact of Tariff Threats

Trump’s threat to impose tariffs on BRICS nations could increase trade tensions, potentially destabilizing the economies of targeted nations. This, in turn, might weaken their currencies while further solidifying the dollar’s dominance. For investors, this suggests a favorable environment for USD-denominated assets in the short to medium term.

3. BRICS’ Limited Influence on the Dollar’s Role

Despite their ambitions, the BRICS nations face significant challenges in creating a unified currency. The disparities in their economic systems, reliance on existing global trade structures, and the dollar’s entrenched role in international finance make such a shift unlikely in the near future. As such, the dollar is expected to maintain its position as the dominant global reserve currency for the foreseeable future.

4. Geopolitical Tensions and Global Trade Impact

Heightened geopolitical risks, including potential trade wars and sanctions, could drive volatility in the currency markets. While the dollar is likely to benefit as a safe haven, currencies like the JPY, traditionally viewed as a stable alternative, might also see increased demand.

What should you do?

The currency market is dynamic, but the dollar’s current dominance provides a solid foundation for beginner investors. Start with small, informed steps and gradually build your portfolio with confidence!