- 2025-01-09

Asian Stock Markets Show Cautious Movement Influenced by the U.S.

Asian stock markets are showing cautious movements at the st……

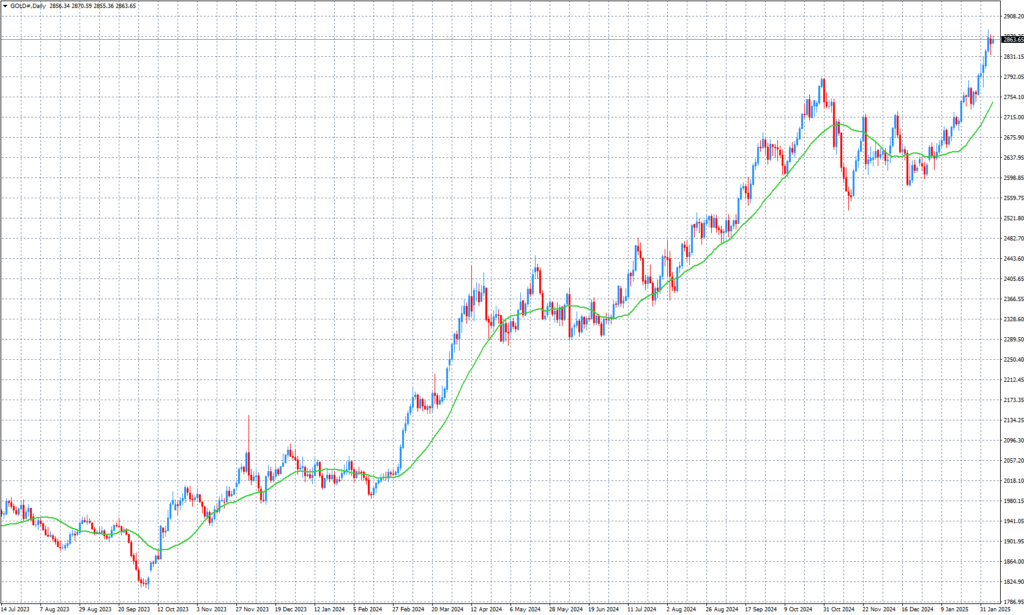

Gold Daily Chart

Gold prices have surged recently, approaching record highs. This movement is driven by uncertainty ahead of the U.S. non-farm payroll data release, along with heightened geopolitical tensions and the U.S.-China trade war. A weakening U.S. dollar has further supported gold prices. Analysts forecast that gold may continue to rise, potentially reaching $3,000 per ounce in the short term. For beginners, gold remains a promising investment option.

The attached chart reveals a consistent upward trend in gold prices from 2023 to 2025. Particularly since mid-2024, the momentum of this rise has strengthened, with recent prices nearing the critical $2,900 level. This movement can be attributed to the following factors:

Analysts predict that gold prices may reach the $3,000 mark in the short term, as suggested by the current market momentum. If the upcoming non-farm payroll data underperforms expectations, gold prices are likely to climb further. Conversely, a strong labor market report might lead to a temporary price correction. Nevertheless, the long-term trend for gold remains bullish.

For those inspired by this article and chart to start investing in gold, using the moving average shown on the chart (green line) is a practical and straightforward way to guide your decisions.

Start small and familiarize yourself with identifying entry points and trends using the moving average. With the current strong upward trend, this is an excellent opportunity to begin your gold investment journey!