- 2025-01-23

Bitcoin Price Recovers to $105,000 as Trump’s SEC Prepares Crypto Policies

The price of Bitcoin rose by 2.7% to $104,991 following the ……

Today’s 5-Minute Chart

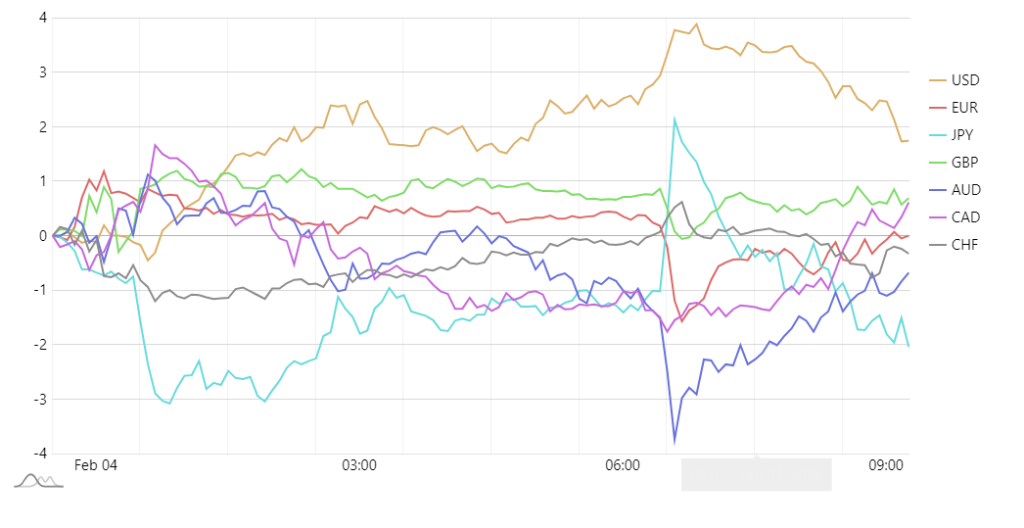

Today’s currency market has been heavily influenced by President Trump’s decisions on trade tariffs. The delay of tariffs on Canada and Mexico has weakened the USD, while the implementation of tariffs on China has added to market uncertainty. Under these circumstances, analyzing the strength of major currencies and developing investment strategies for the European and American markets are essential.

Based on the attached currency strength chart, the following trends are observed:

Overall, risk-averse sentiment is driving some of the market movements, favoring safe-haven currencies.

Short- to medium-term trades are recommended. In the current uncertain environment, focusing on short-term trends and maintaining flexibility is more effective than long-term investments.

For beginners, it is advisable to focus on safe-haven currencies such as the Japanese yen and Swiss franc. These currencies are likely to benefit from risk-averse movements in the short term. Additionally, the euro’s stable performance makes it a viable option for investments in the European market.

Conversely, the USD and AUD are highly reactive to news events, so a cautious approach is necessary. Start with small trades, observe chart movements, and gradually gain experience. By managing risks and taking small steps, you can build confidence in your trading journey.